Is there a health insurance penalty for not having health insurance?

No, the penalty for not having health insurance was a component of the Affordable Care Act (ACA) in the United States. This penalty, often referred to as the individual mandate penalty, required most Americans to have health insurance coverage or pay a fine when filing their federal income tax returns. However, it’s important to note that the health insurance penalty was effectively reduced to $0 starting in 2019, as part of the Tax Cuts and Jobs Act passed in 2017.

Importance of health insurance

In today’s world, health insurance plays a crucial role in ensuring access to quality healthcare services. It acts as a safety net, providing financial protection and peace of mind during medical emergencies and routine healthcare needs. Health insurance allows individuals to seek medical attention without the burden of exorbitant costs, which can otherwise lead to significant financial strain. Beyond just covering medical expenses, health insurance encourages preventive care and early intervention, contributing to overall well-being. However, the absence of health insurance comes with its own set of consequences. Not having health insurance can lead to potential penalties and challenges in accessing timely and necessary medical care. It’s essential to understand these implications to make informed decisions about securing the appropriate coverage.

Overview of Health Insurance Penalty

The health insurance penalty, also known as the individual mandate penalty, was a measure introduced as part of healthcare reform efforts, specifically associated with the Affordable Care Act (ACA) in the United States. The purpose of this penalty was to encourage individuals to obtain and maintain health insurance coverage, aiming to achieve a broader goal of increasing the number of people with access to healthcare services and spreading the risk among a larger pool of insured individuals.

The concept behind the health insurance penalty

It was rooted in the idea of shared responsibility. By requiring individuals to have health insurance coverage, the goal was to create a balanced risk pool that includes both healthy and less healthy individuals. This would help stabilize insurance markets, prevent adverse selection (where only those in need of immediate medical care enroll), and ultimately make healthcare coverage more affordable for everyone.

The health insurance penalty was introduced to motivate individuals who might otherwise choose to forego health insurance coverage, either due to cost concerns or a perception of low personal health risk. By including a financial consequence for not having coverage, lawmakers aimed to encourage healthier individuals to participate in the insurance system, thereby supporting the overall sustainability of healthcare programs.

Linked to the Affordable Care Act:

The penalty was intended to work in tandem with other provisions of the ACA, such as the establishment of health insurance marketplaces (exchanges) where individuals could compare and purchase insurance plans. However, it’s important to note that the penalty’s significance changed over time. While initially enforced, the penalty amount was reduced to $0 starting in 2019 as part of the Tax Cuts and Jobs Act, effectively nullifying the financial consequence for not having health insurance coverage.

Overall, the health insurance penalty represented an attempt to create a more inclusive and financially stable healthcare system by encouraging broader participation in health insurance programs.

Penalty Calculation

The calculation of the health insurance penalty, or individual mandate penalty, was based on specific criteria tied to an individual’s tax filing. It’s important to note that this penalty was associated with the Affordable Care Act (ACA) and was in effect until it was reduced to $0 starting in 2019.

The penalty calculation took into account several factors, primarily aimed at assessing an individual’s compliance with the requirement to have health insurance coverage throughout the year. The penalty was calculated based on whichever of the following two amounts was greater:

1. A flat dollar amount per uninsured adult and a reduced amount per uninsured child (up to a family maximum).

2. A percentage of the household’s income that exceeded the income threshold required for tax filing.

Factors that influenced the penalty amount included:

– Income: The penalty amount increased for individuals with higher income levels. The higher an individual’s income, the larger the penalty could be.

– Family Size: The penalty took into account the number of people in the household without insurance coverage. A higher number of uninsured individuals in a household could result in a larger penalty.

– Coverage Gaps: The penalty was also influenced by the duration of coverage gaps. If an individual lacked coverage for only part of the year, the penalty would be pro-rated based on the number of months without coverage.

Here are a couple of simplified examples of how the penalty might be calculated for different scenarios:

Example 1: Individual Penalty Calculation

– Individual income: $40,000

– Flat dollar penalty per adult: $695

– Percentage of income penalty: 2.5% (income above a certain threshold)

– Penalty amount (whichever is greater): $695

Example 2: Family Penalty Calculation

– Family income: $80,000

– Family size: 2 adults and 2 uninsured children

– Flat dollar penalty per adult: $695

– Reduced amount per uninsured child: $347.50

– Percentage of income penalty: 2.5% (income above a certain threshold)

– Penalty amount (whichever is greater): $695 + $347.50 = $1,042.50

It’s important to remember that these examples are simplified and that the actual penalty calculation could be influenced by various additional factors, including specific income thresholds, tax filing status, and more. Additionally, as previously mentioned, the penalty amount was reduced to $0 starting in 2019.

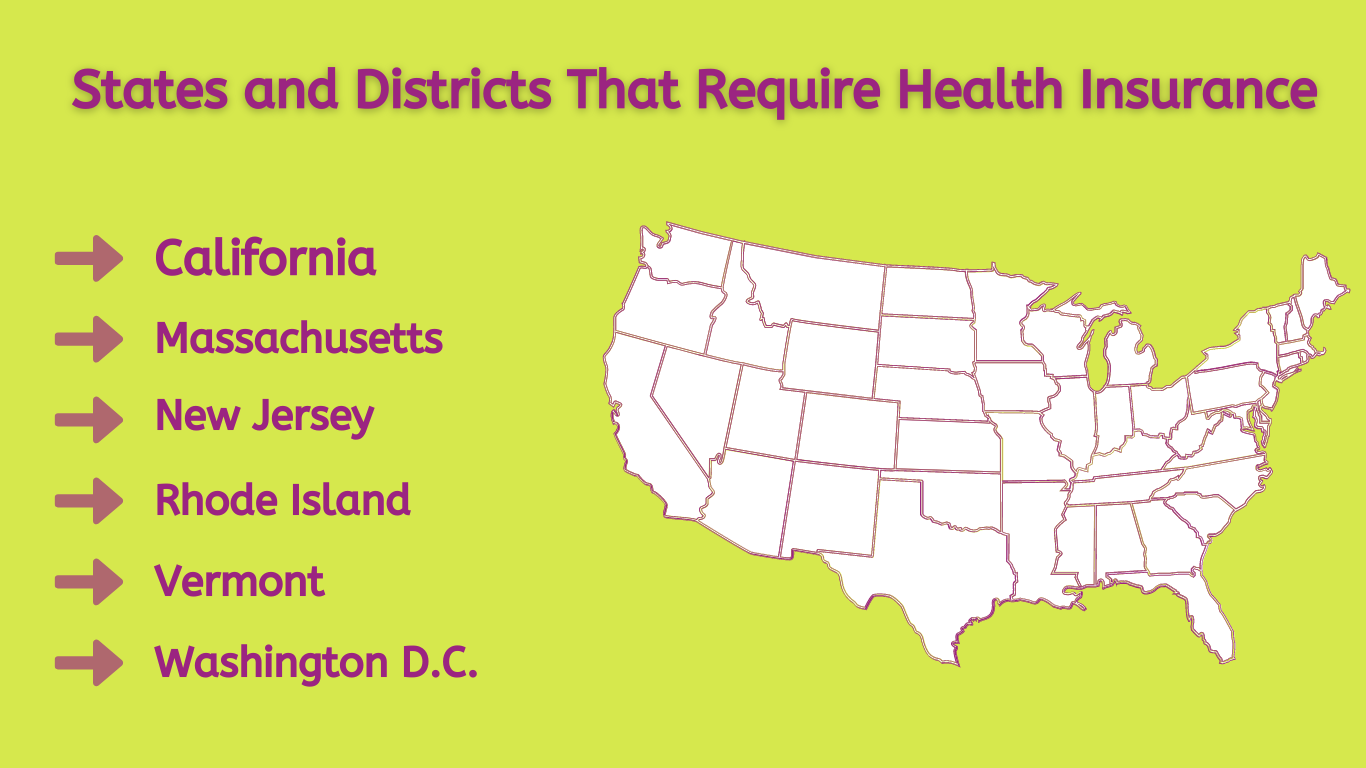

Which States Require Health Insurance?

Currently, health insurance is mandatory in five states and one district. Failure to possess medical insurance in the following regions may result in a tax penalty:

– Massachusetts

– New Jersey

– Vermont

– California

– Rhode Island

– District of Columbia (Washington D.C.)

It’s essential to closely examine the viability of affordable health insurance within these states if you’re aiming to evade tax penalties on your income tax but are grappling with the affordability of health coverage. Should your income be below 400% of the federal poverty level, you might qualify for advance premium tax credits or other subsidies that can mitigate the cost of your health insurance premiums. Whether you reside in your current state or plan to relocate, Smart Insurance Agents is at your service to address any inquiries or apprehensions regarding health insurance. Gain a deeper understanding of the prerequisites for health insurance and the regulations specific to your state to sidestep penalties and discover the optimal plan catering to your requirements.

Penalty Exemptions

Various exemptions were available to individuals that allowed them to avoid the health insurance penalty, also known as the individual mandate penalty, under the Affordable Care Act (ACA). These exemptions recognized that certain circumstances might genuinely prevent individuals from obtaining health insurance coverage and thus warranted an exclusion from the penalty.

Common exemptions included:

1. Financial Hardship: Individuals who experienced financial hardship and could not afford health insurance coverage could qualify for an exemption. This was assessed based on factors like income and the cost of available insurance plans in the area.

2. Religious Beliefs: Those with religious beliefs that were opposed to accepting benefits from a health insurance policy could apply for an exemption. This recognized the diversity of religious practices and beliefs.

3. Certain Life Events: Exemptions were provided for individuals facing specific life events that could disrupt their ability to secure health insurance coverage. Examples included experiencing homelessness, bankruptcy, eviction, or being a victim of domestic violence.

4. Short Coverage Gap: Individuals who had a coverage gap of less than three consecutive months during the year were exempt from the penalty. This recognized that short gaps might occur due to changes in employment or other reasons.

5. Certain Noncitizens: Some non-U.S. citizens, such as undocumented immigrants or individuals in certain visa categories, were exempt from the penalty.

6. Incarceration: Individuals who were incarcerated were considered exempt from the penalty during the period of their confinement.

It’s crucial to understand the exemption criteria and apply for exemptions if eligible. This process required accurate documentation and verification of the circumstances that qualified for exemption. Applying for an exemption helped individuals avoid unnecessary penalties while ensuring that the penalty system targeted those who could reasonably afford health insurance coverage but chose not to obtain it.

Changes and Repeals:

Over time, the health insurance penalty, also known as the individual mandate penalty, has undergone significant changes and updates due to policy shifts and legislative actions. One of the notable changes occurred through the Tax Cuts and Jobs Act, which was passed in December 2017. This legislation effectively reduced the penalty to $0, starting in 2019. This reduction was part of a broader effort to dismantle certain provisions of the Affordable Care Act (ACA).

The decision to reduce the penalty to $0 was driven by debates over individual choice, the role of government in healthcare, and the perceived effectiveness of the penalty in achieving its intended goals. Critics argued that the penalty imposed a financial burden on individuals who might not find suitable or affordable insurance options, while supporters believed it was necessary to incentivize broader participation in the healthcare system and stabilize insurance markets.

This change brought about several consequences. On one hand, it removed the financial consequence for not having health insurance coverage, essentially nullifying the penalty’s impact. On the other hand, it raised concerns about potential destabilization of insurance markets due to reduced participation, as healthier individuals might choose to forego coverage without the penalty in place.

Alternatives to Traditional Health Insurance:

For individuals without traditional health insurance, there are alternative options worth considering to address their healthcare needs. These alternatives can provide different approaches to managing medical costs and accessing care. Some options include:

1. Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that allow individuals to save money specifically for medical expenses. They are usually paired with high-deductible health insurance plans. Contributions to HSAs are tax-deductible, and funds can be used to cover a range of qualified medical expenses. HSAs offer flexibility and control over healthcare expenses, but it’s important to carefully review plan details and ensure they align with your needs.

2. Health Sharing Ministries: Health sharing ministries are faith-based organizations where members pool their money to help cover each other’s medical expenses. These are not insurance plans, but they function similarly by distributing funds among members in need. While these programs can offer cost-sharing solutions, they might not provide the same level of comprehensive coverage as traditional insurance plans.

3. Short-Term Health Plans: Short-term health plans provide temporary coverage for a limited duration, usually up to a year. They can be more affordable but often come with limitations and may not cover pre-existing conditions or provide comprehensive benefits. These plans can be suitable for bridging coverage gaps, but they might not be a long-term solution for comprehensive healthcare needs.